The analysis of ratios related to sales measure the profitability or the operational efficiency of the firm. This ratios reflect the final results of business operations.

They are some of the most closely watched and widely quoted ratios. Management attempts to maximize these ratios to maximize the firm’s value.

The result of the firm can be evaluated in terms of its earning with reference to a given level of assets or sales or owner’s interest etc. Therefore , the profitability ratios are broadly classified in four categories:

i) Profitability ratios related to sales

ii) Profitability ratios related to overall return on investment

iii) Profitability Ratios required for Analysis from Owner’s Point of View

iv) Profitability Ratios related to Market/ Valuation/ Investors

i) Types of Profitability ratios related to sales

a) Gross profit ratio

It measures the percentage of each sale in rupees remaining after payment for the goods sold.

Gross profit ratio = Gross Profit ➗ Sales ✖ 100

Gross profit margin depends on the relationship between sales price, volume and costs. A high Gross Profit Margin is a favorable sign of good management.

b) Net Profit ratio

It measures the relationship between net profit and sales of the business. Depending on the concept of net profit, it can be calculated as :

Net profit ratio = Net Profit ➗ Sales ✖ 100 or Earning after taxes (EAT) ➗ Sales ✖ 100

Pre-tax profit ratio = Earning before taxes (EBT) ➗ Sales ✖ 100

Further, Net Profit ratio finds the proportion of revenue that finds its way into profits after meeting all expenses. Moreover, a high net profit ratio indicates positive returns from the business.

c) Operating Profit ratio

Operating profit ratio is also calculated to evaluate operating performance of business.

Operating profit ratio = Operating Profit ➗ Sales ✖ 100

or,

Earnings before interest and taxes (EBIT) ➗ Sales ✖ 100

Where, Operating Profit = Sales – Cost of Goods Sold (COGS) – Operating Expenses

Further, Operating profit ratio measures the percentage of each sale in rupees that remains after the payment of all costs and expenses except for interest and taxes. This ratio is followed closely by analysts because it focuses on operating results. Operating profit is often referred to as earnings before interest and taxes or EBIT.

d) Expenses Ratio

Based on different concepts of expenses it can be expresses in different variant as below:

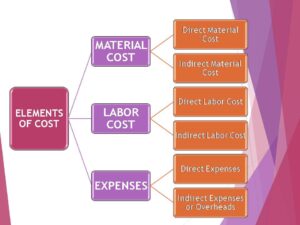

i) Cost of goods sold ratio (COGS) = COGS ➗ Sales ✖ 100

ii) Operating Expenses Ratio = Administrative exp.➕selling and distribution OH➗ Sales✖100

iii) Operating ratio = COGS➕ Operating expenses ➗ Sales✖100

iv) Financial Expenses ratio = Financial expenses* ➗ Sales✖100

*It excludes taxes ,loss due to theft , goods destroyed by fire etc.

Moreover, administration Expenses Ratio and Selling & Distribution Expenses Ratio can also be calculated in similar ways.