Petty Cash Book is prepared to record small payments such as telegram, taxi fare , cartage and stationery etc.

In a business house a number of small payments such as for telegrams, taxi fare , cartage etc. have to be made. If all of these payments are recorded int he cash book, it will become unnecessarily heavy. Also the main cashier will be overburdened with work. Therefore it is usual for firms to appoint a person as petty cashier. And delegates the task of making small payments say below Rs. 200 to him . Of Couse he will be reimbursed for the payments made.

What is imprest system of cash book?

It is convenient to delegate a definite sum of money to the petty cashier in the beginning of the period. And to reimburse him for payments made at the end of the period.

Thus, he will have again the fixed amount in the beginning of new period. Such a system is known as imprest system of petty cash book .

In addition the system is very useful specially if an analytical petty cash book is used. Further, the book has one column to record receipt of cash and other column to record payments of various types.

The total of various column show why payments have been made and then relevant accounts can be debited.

i) The amount fixed for petty cash should sufficient for the likely small payments for a relatively short period say for a week or fortnight.

ii) The reimbursement should be made only when petty cashier prepares a statement showing total payments supported by vouchers, i.e. documentary evidence and should be limited to the amount of actual disbursements.

iii) Besides , the voucher should be filed in order.

iv) In addition above no payments should be made without proper authorization. Also, payments above a certain specified limit should be made only by the main cashier.

v) Further, the petty cashier should not be allowed to receive any cash except for reimbursement.

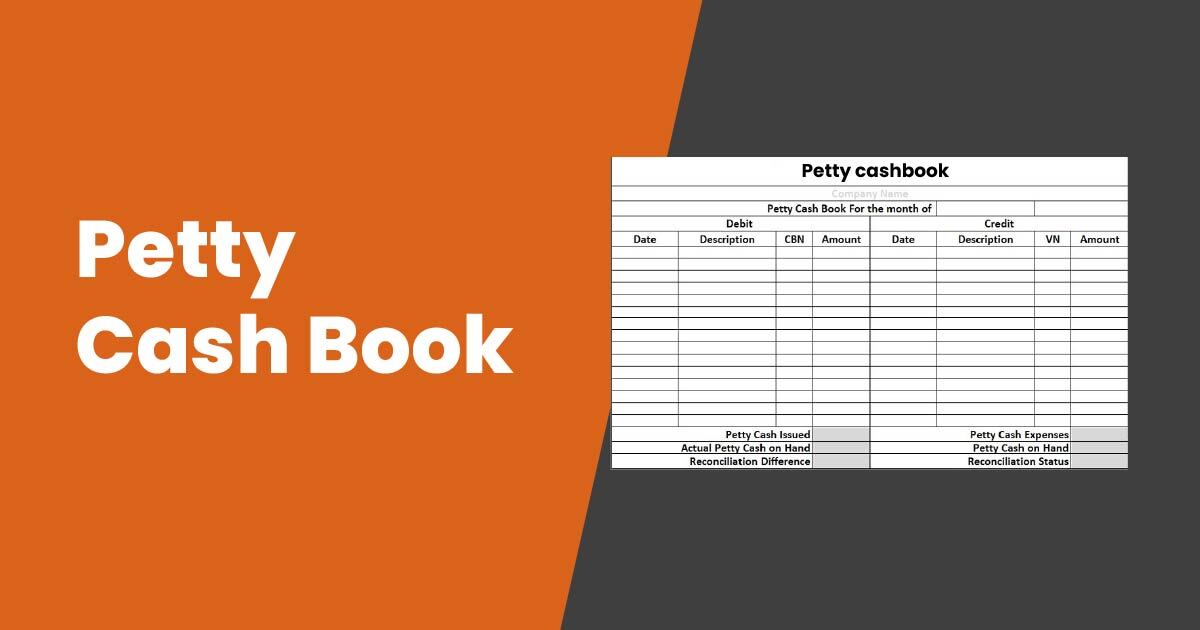

In addition, in petty cash book the extreme left hand column records receipt of cash .The money column towards the right hand shows total payments for various purposes; the column is usually provided for sundries to record infrequent payments. The column is analyzed .

And then, at the end of the week or the fortnight the petty cash book is balanced. the method of balancing is same as for the simple cash book.

What are the advantages of petty cash book?

There are mainly three advantages :

- Saving of time of the chief cashier

- And saving in labour in writting up the cash book and posting in to the ledger; and

- Finally control over the small payments

Posting the petty cash book

In the ledger the petty cash account is maintained; when amount is given to the petty cashier, the petty cash account is debited. Each week or fortnight, the total of the payments made is credited to this account.

At this point, the petty cash account will then show the balance in the hand of the cashier; on the demand he will should be able to produce it for counting .

Further, at the end of the year the balance is shown in the balance sheet as part of cash balances.

Moreover, the payment must be debited to their respective amounts as shown by the petty cash book. For this two method may be used :

i) From the petty cash book the total of the various column may be directly debited to the concern accounts; or

ii) Moreover, a journal entry may first be prepared on the basis of the petty cash book , debiting the accounts shown by the various analysis columns, and crediting the total of the payments of the petty cash accounts.

Illustration

Prepare petty cash book on the imprest system from the following:

| 2023 | Rs. | |

| Jan 1 2 3 4 5 | Received Rs. 100 for petty cash Paid bus fair Paid Cartage Stationery Paid for postage And, paid wages for casual laborer’s | 50 15 2 6 25 |

| Receipts (Rs.) | Date 2023 | V. No. | Particulars | Total (Rs.) | Conv- eyance (Rs.) | Cartage | Sation- ery (Rs.) | Postage (Rs.) | Wages (Rs.) |

| 100 | Jan 1 | To cash | |||||||

| 1 | 1 | By conveyance | 50 | 50 | |||||

| 2 | 2 | By cartage | 15 | 15 | |||||

| 3 | 3 | By stationery | 2 | 2 | |||||

| 4 | 4 | By postage | 6 | 6 | |||||

| 5 | 5 | By Wages | 25 | 25 | |||||

| 98 | 50 | 15 | 2 | 6 | 25 | ||||

| By balance c/d | 2 | ||||||||

| 100 | 100 | ||||||||

| 2 | To balance b/d |