Income tax refund Meaning and how to claim refund?

Income tax refund is a repayment made to taxpayer for any excess amount paid in taxes to income tax department. Refund can be expected if you have paid more than actually required.

What is Income tax refund??

It is an amount that is paid back to you by the income tax department because you have paid more than what is actually required.

For instance you TDS on salary is deducted and deposited by your employer is Rs. 15,000. But at the time of filing ITR your actual tax liability is Rs.12,000 than you are eligible for refund for Rs.3,000.And can claim by filing ITR.

Further, it is arises when tax paid is greater than what is actually chargeable . In brief, it is an reimbursement of excess tax paid to the Govt.

It is an excess tax paid will be returned to you in form of refund.

Again, a taxpayer is eligible for refund when tax paid is higher than actual liability like you paid more advance tax, TDS or self assessment tax.

When can the assessee be eligible for refund?

1. When self assessment tax is paid more than actual tax liability.

2.Tax deducted at source (TDS) on salary, rent, professional income or interest etc. is higher than actual tax liability.

3. When income charge in India and foreign country with whom Indian Govt. has an DTA agreement.

4. When advance tax is paid more than actual tax liability.

How to claim Income tax refund??

An assessee can claim refund by filing ITR for financial year. Taxpayer can claim refund only if he/she eligible for any refund. It means tax paid is more than actual tax liability. Now govt. transfer refund electronically .But it is important to note that after filing ITR it should be e-verified.

After e-verification, if assessing officer satisfies that the tax paid by you is more than amount payable then department will process ITR and will issue refund by sending intimation u/s 143(1). And then refund will be credited to your bank account .

How to check income tax refund status??

After processing of ITR a taxpayer can check refund status online. However , can check refund status in following ways:

a) Income tax e-filing portal or,

b) NSDL portal

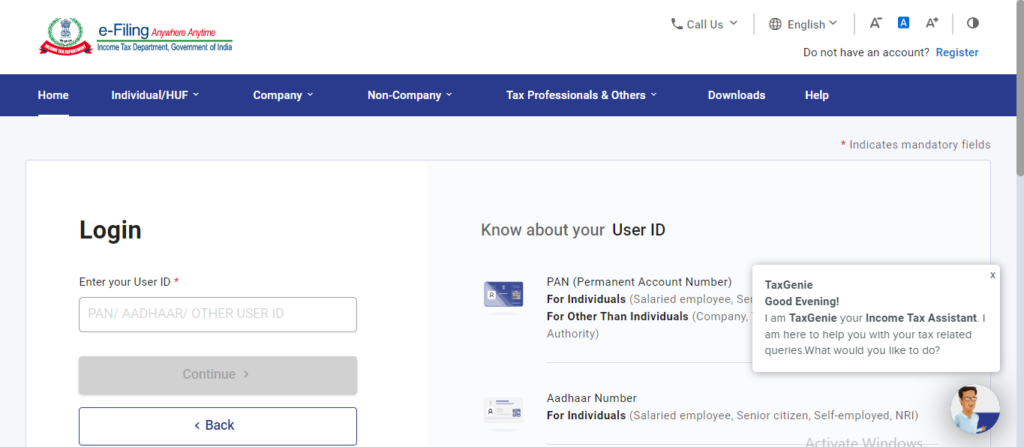

Steps to check refund status through e-filing portal:

- Go to Income tax e-filing portal .

- Login to your account by entering PAN and password

- Click on my account

- click on view e-filed return

- click on refund status and refund status will display on your screen.

Steps to check refund status through NSDL portal:

- Go to NSDL portal .

- Enter PAN and assessment year.

3.refund status will display on your screen.

Is there interest on income tax refund ??

As per the income tax rules it is mandatory for the income tax department to pay interest on refund.

Further, as per the section 244A of the act interest on income tax refund is 0.5% per month or part of the month. However you cannot get any interest on refund if refund amount is less than 10% of tax determined u/s 143(1) or tax determined under regular assessment.

Adjustment of refund against outstanding demand

If there is demand of any particular year and you have refund for another year than tax department will not pay the refund rather they will adjust your refund against outstanding demand.

Frequently asked question

1. What is the rate of interest on income tax refund ??

Simple interest at 0.5% per month or part of the month .

2. How to check income tax refund status online??

You can check refund status online through www.incometaxefiling or NSDL portal and steps to check status is noted above.

3. Is income tax refund is taxable??

No, however, interest on IT refund is taxable under other source of income head.

4. How long does it take to get IT refund credit??

IT dept. will process refund only after processing ITR. It takes about 30 to 45 days after e-verification of ITR.

5. What to do if income tax refund is returned due to incorrect bank account number provided ??

You are required to submit refund reissue request by login your account on efiling portal.

[…] How to check refund status: refer https://taxandfinanceguide.com/income-tax-refund/ […]