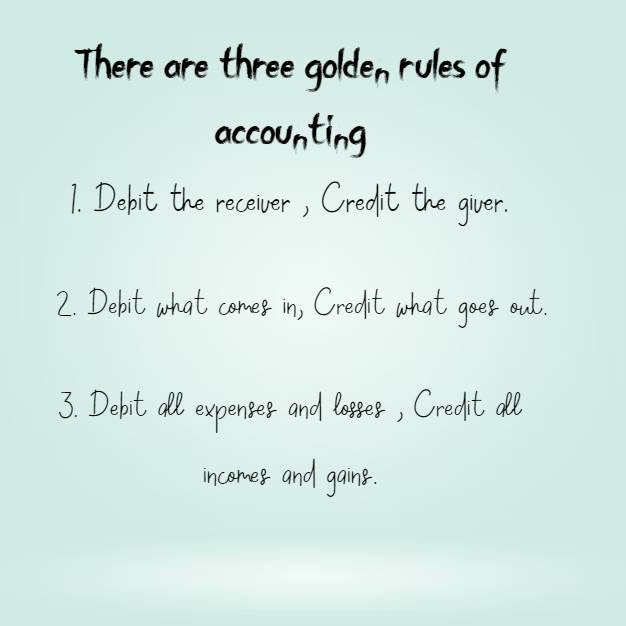

There are three Golden rules of accounts are as follows:

1. Debit the receiver , Credit the giver

2. Debit what comes in, Credit what goes out.

3. Debit all expenses and losses , Credit all incomes and gains.

Let us understand these rules in detail

1. Debit the receiver , Credit the giver

The rule of Debit the receiver , Credit the giver is related to personal account and it is the first golden rules of accounts. For instance , if you receive something debit the account and if you give something credit the account.

What is Personal Account in accounting?

Personal accounts are relates to persons, trade receivable or trade payables. For example account of Ram a credit customer or account of Mahavir a supplier of goods.

Further, the capital account is the account of proprietors and therefore, it is also personal account but adjustment on account of profit and losses are also made in it .

This account is further classified into three categories:

a) Natural Personal Account : It relates to transactions of human binge like Ram or Riya , Radha etc.

b) Artificial (legal) Personal Account: For business purpose , business entity are treated to have separate entity. They are recognized as person in eyes of law for dealing with other persons. For example Government , Companies (Private or Public) or Cooperative societies etc.

b) Artificial (legal) Personal Account: For business purpose , business entity are treated to have separate entity. They are recognized as person in eyes of law for dealing with other persons. For example Government , Companies (Private or Public) or Cooperative societies etc.

For instance, Mr. Amit paid Rs. 4,000 for office supplies . Now Mr. Amit debit the supplier (debit the receiver) and credit the cash/bank account (i.e. credit the giver).

2. Debit what comes in, Credit what goes out.

Second golden rules is used for real account. Real account is called as permanent account.

Further, real account don’t close at year end instead their balances are carried over to next period.

Real Account: Accounts which relates to assets of the firm but not debt. For example accounts regarding land and building, fixed deposit , investments etc. are real account. Cash in hand or cash at bank are also real account.

When something comes in business is debited and credit the account when something goes out of business .

For instance, Mr. A purchased Land for Rs. 1,50,000 in cash. So, debit the Land account (i.e. what comes in) and credit the cash account (i.e. what goes out).

Land A/c ………….Dr. 1,50,000

To Cash/Bank A/c……………. 1,50,000

3. Debit all expenses and losses , Credit all incomes and gains

The third Golden rules of accounts is deals with nominal account. Nominal account is account that close at the year end.

Further, Accounts which related to expenses, losses , gains or revenue etc. like salary account, interest paid account, commission received account, electricity expenses account ,Repair and maintenance account or depreciation account .

Moreover, the net result of all nominal accounts is reflected as profit or loss which is transferred to capital account . Nominal account are therefore, temporary.

When you incur expenses debit the account and all incomes and gains will be credited.

For instance, 1) Mr. A incur an office expenses of Rs. 1500 in cash. So, debit the office expense account (i.e. debit all expenses and losses) and credit the cash/bank account (i.e. credit all incomes and gains).

2) Mr. X sold goods of Rs. 20,000 to Mr. Y . Then Mr. X must credit the incomes in sales account.

Cash/Bank A/c …………….Dr. 20,000

To Sales A/c 20,000

Refer: https://taxandfinanceguide.com/classification-types-of-accounts-in-accounting/