Sec. 194-O of income tax act

According to Sec. 194-O of income tax act ,any payment by e-commerce operator is required to deduct tds @at the rate of 1%. on gross amount. 1. What is section 194-O of income tax act? If sale of goods or…

According to Sec. 194-O of income tax act ,any payment by e-commerce operator is required to deduct tds @at the rate of 1%. on gross amount. 1. What is section 194-O of income tax act? If sale of goods or…

A bank, co-operative bank or a post office, who is responsible for paying any sum in cash to an account holder is required to deduct TDS on cash withdrawal u/s 194N. 1. What is section 194N TDS on cash withdrawal…

Sec. 194R of income tax act has been inserted with effect from July 1, 2022. According to sec.194R of income tax act any person responsible for providing any perquisite or benefit pertaining to business/profession carried on by deductee, is responsible…

Section 44ADA of income tax act provides that income of an assessee, engaged in profession referred u/s 44AA shall be calculated on estimated basis at sum equal to 50% of the total gross receipt. What is section 44ADA of income…

Section 10(1) of income tax act provides that agriculture income is not to be included in total income of assessee. Further, the reason for total exemption of agriculture income from scope of central income tax is that the under constitution…

Section 14A of income tax act provides that expenditure incurred by assessee in relation to exempt income is not deductible. Further, section 14A inserted from assessment year 1962-63, provides that no deduction shall be made in respect of expenditure incurred…

Section 24 of income tax act allows two deduction i.e. i) standard deduction & ii) deduction against interest on home loan. Content 1.What is section 24 of income tax act? 2.What is standard deduction u/s 24 of income tax act?…

Section 35D of income tax act -certain preliminary expenses incurred by Indian company before commencement of business shall qualify for amortization. 1.What is section 35D of income tax act? Section 35D of income tax act introduced to claim deduction of…

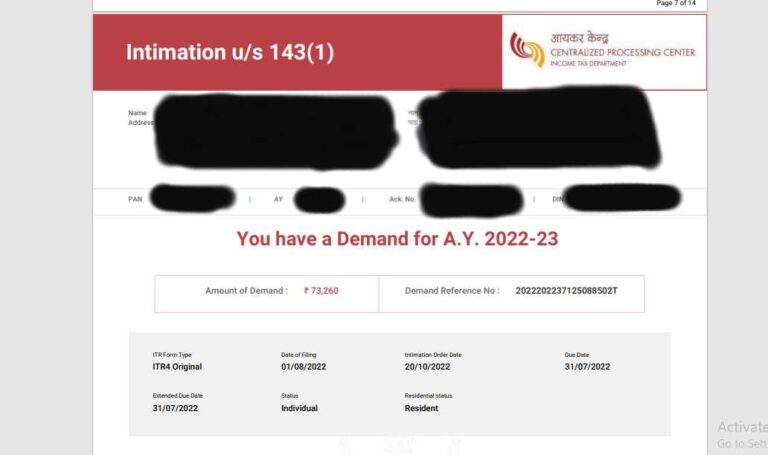

Section 143(1) of income tax act is a communication that the income tax department send to the taxpayer after processing the income tax return and informing them about result. Content 1.What is section 143(1) of income tax act? section 143(1)…

Capital gain on sale of agriculture land is exempted to an individual/ HUF as per the provision of section 54B of income tax act. Content 1.What is section 54B of income tax act? 2.Who can claim exemption of capital gain…