Capital asset pricing model provides an conceptual framework for evaluating any investment decision. And explains the relationship between expected return and risk of investing in a security.

1.What is Capital asset pricing model?

The CAPM distinguishes between risk of holding a single asset and holding a portfolio of assets. There is a trade-off between risk and return. Modern portfolio theory concentrates on risk and stresses on risk management rather than on return management.

Further, CAPM provides an conceptual framework for evaluating any investment decision. Where capital is committed with a goal of producing future returns.

CAPM explains the relationship between expected return and risk of investing in a security.

Further, it can be used to decide prices of securities. However, CAPM requires evaluation of systematic and unsystematic risk. Systematic risk is market related component of portfolio risk. Wars, inflation rates and recessions are example of systematic risk. Besides, it is commonly measured by regression coefficient Beta or the Beta coefficient. Low Beta reflects low risk and high Beta reflects high risk.

Whereas, Unsystematic risks can be averted through diversification and is related to random variables. In addition the unsystematic risk can be diversified by building a portfolio, the relevant risk for determining the prices of securities is the non-diversifiable component of the total risk.

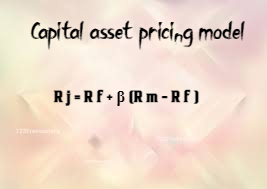

2.What is the formula for CAPM ?

E(r) = Rf +(Rm -Rf )xβ

Whereas, E(r) = Required return

Rf = Risk free return

Rm = Average return on the capital market (market return)

β = Beta factor of the underlying

However, CAPM is based on certain assumptions to provide conceptual framework for evaluating risk and return.

3.Some of the important assumptions are as follows:

- Efficient market: It is the first assumption of CAPM. Efficient Market refers to the existence of competitive market. In addition, where financial securities and capital assets are bought and sold with full information of risk and return available to all participants.

Further, in an efficient market the price of individual assets will reflect a real or intrinsic value of a share as the market prices will adjust quickly to any new situations.

- Rational investment goals: Investors desire higher return for any acceptable level of risk or the lowest risk for any desired level of return. However, such a rational choice is made on logical and consistent ranking proposals in order of preference for higher good to lower good. Further, this is the scale of the marginal efficiency of capital.

- Moreover, securities can be exchanged without payment of brokerage, commissions or taxes and without any transaction cost.

- CAPM assumes all assets are divisible and liquid.

- Investors are able to borrow freely at a risk less rate of interest i.e. borrowings can fetch equal return by investing in safe Government securities.

- Further, securities or capital assets face no bankruptcy or insolvency.

- In addition, CAPM assumes that the Capital Market is in equilibrium.

- Securities or capital assets face no bankruptcy or insolvency.

- Securities can be exchanged without payment of brokerage, commissions or taxes and without any transaction cost.

4.What is Beta (β) in CAPM?

Beta of a security is a measurement of its volatility of return relative to its market. And is used to measure risk. The beta for the market is equal to 1.0. Further, beta explains the systematic relationship between the return on a security and the return on the market by using a simple linear regression equation.

Company with higher beta with higher risk and higher return.

5.Example of capital asset pricing model.

1. XYZ Ltd beta is 1.40. The market return is 14% and risk free return is 10%. What is expected return of the XYZ Ltd as per CAPM?

Computation of expected return based on CAPM

E(r) = Rf +(Rm -Rf )xβ

=10%+(14%-10%)X1.40

=10%+5.6%

= 15.6%

2. risk premium of a market is 10% . Assuming beta values of security R are 0, 0.25, .42, 1.00 and 1.67 . Calculate the risk premium on security R.

Solution: Market risk premium is 10% .

| Beta (β) value of R | Market risk premium | Risk Premium of R |

| 0.00 | 10% | 0% |

| 0.25 | 10% | 2.50% |

| 0.42 | 10% | 4.20% |

| 1.00 | 10% | 10.00% |

| 1.67 | 10% | 16.70% |

[…] Refer:https://taxandfinanceguide.com/cost-of-capital/ and https://taxandfinanceguide.com/capital-asset-pricing-model/ […]