Cash transactions are straight way recorded in the cash book & on the basis of such record ledger accounts are prepared.

What is Cash Book?

All cash transactions are recorded in the cash book. All transactions in cash book have two sides: a) all receipts are recorded in debit sides of cash book and b) all payments or disbursement are recorded in the credit side of the book. And, cash book includes bank deposits and withdrawal.

Further, difference between debit and credit side of cash book shows the balance of cash on hand, if cash flow is positive and vice-versa.

Therefore , the primary goal of cash book is to manage cash efficiently.

Is CB a subsidiary book or a principal book?

Cash transactions are straight way recorded in the cash book & on the basis of such record ledger accounts are prepared. Therefore cash book is a subsidiary book .

But, the cash book itself serves as the cash account and the bank account ; the balances are entered in the trial balance directly . The cash book therefore is a part of the ledger also. Hence, it has also to be treated as principal book. The cash book is thus both a subsidiary book and a principal book.

How many types of cash book?

The main cash book may be of the three types:

1.Simple cash book

2.Double-column cash book

3.Three-column cash book

In addition to the main cash book firm generally maintain petty cash book but that is a purely a subsidiary book.

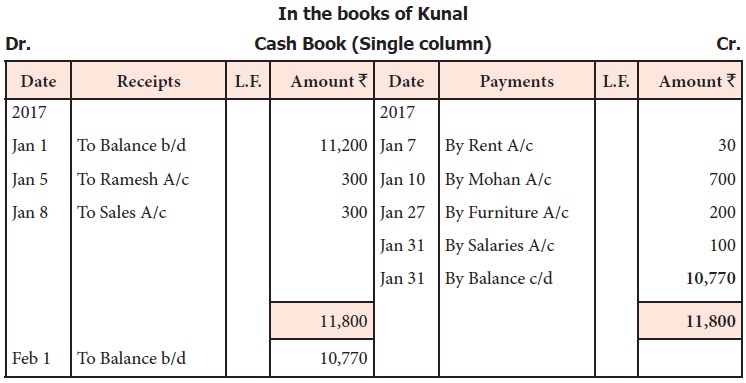

1. Simple cash book

This cash book appears like an ordinary account , with one amount column on each side.

The left hand side (i.e. debit) records receipts of cash and right hand side(i.e. credit) records the payment.

Balancing of simple CB:

The CB is balanced like other accounts. Total of receipt column is always greater than the payment column . The difference is written on the credit side as ‘By balance c/d’. The totals are then entered in two column opposite one another and then on debit side of balance is written as “To balance b/d”, to show cash balance in hand in the beginning of next period.

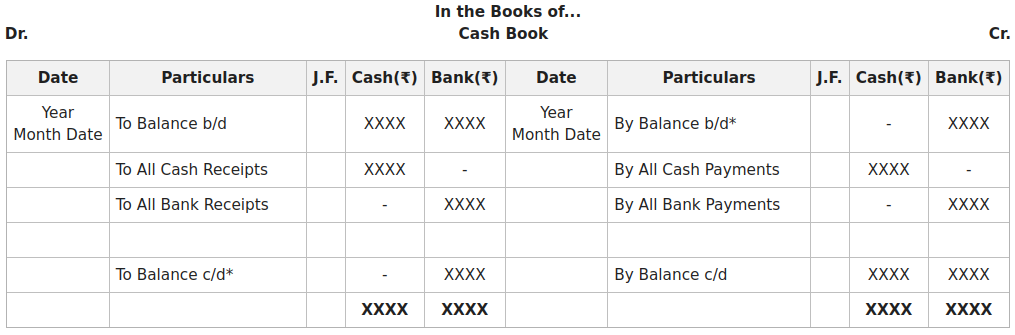

2.Double-column cash book

If along with column for amounts to record cash receipts and cash payments another column is added on each side to record cash discount allowed or discount received , or a column on debit side showing bank receipt and another column on credit side showing payments through bank. It is double column cash book.

Cash discount is an allowance which often accompanies cash payments. For example , if customer owes Rs. 500 but it is promised that 2% will be deducted if payment made is within the certain period. The customer can clears his account by paying promptly Rs. 490 & Rs 10 will be discount for the firm, receiving the payment discount it is a loss. And for the person making payment it is a gain.

Since cash discount is allowed only if cash is paid. It is convenient to add column for discount allowed on receipt side of CB and a column for discount received on the payment side of CB.

In cash column on debit side , the actual cash received is entered . The amount of discount allowed ,if any to the customer concerned is entered in the discount column.

Similarly, actual cash paid is entered in the cash column on payment side and discount received in discount column. Also the bank column on debit sides records all receipts through bank. And same column on credit sides shows payment through bank .

Balancing of double column CB

It should be noted that the discount columns are not balanced. They are merely totalled. Total of discount column on receipt sides shoes total discount allowed to customer and is debited to discount account. Total of the column on payment side shows total discount received and credited to discount account. The cash column are balanced , as shown already.

The bank columns are also balanced and the balancing figure is called bank balance . Thus double column cash book should have two columns on each side comprising of either cash and discount transaction or cash and bank transaction.

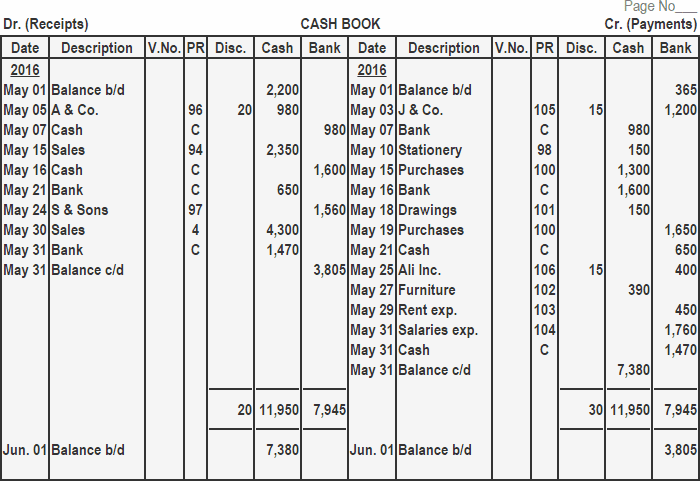

3.Three-column cash book

A firm normally keeps the bulk of its funds at bank, money can be deposited and withdrawn at will if it a current account. Probably payments into and out of bank are more numerous than strict cash transactions. There are only little difference between cash in hand and money at bank.

Therefore it is appropriate , if one side in CB , another column is added to record cash deposited at bank and payment out of the bank.

Following points should be noted for writing up three-column CB

- Commencing new business , amount is written in cash column if it is introduced in business. And in the bank column if it is directly put into bank with the description “To capital account”. And if new CB is started for existing business , the opening balance are written as “To balance b/d”.

- All receipts are recorded on receipt side ; cash in cash column and cheques in bank column. And discount allowed is entered on discount column. And in the particular column the name of account in respect of which payment has been received as written.

3.All payments are written off on payment side, cash payment on cash column and payment by cheques in bank column. If discount is received it is entered in discount column.

4.Contra Enries:

- Often cash is withdrwan from bank for office use. In such case amount is entered on payment side of bank column and also on receipt side of cash column.

- In the reverse case cash is being deposited in to the bank ,the amount is recorded on the bank column of receipt side and in cash column on payment side.

- Against such entries “C” should be written in LF column to indicate that these are the contra transaction ad no other posting is required.

- While recording contra entries basic but important rule should be followed:

a) The Receiver Dr.

The Giver Cr.

b) All what comes in Dr.

All what goes out credit Cr.

For example:

i) If cash is deposited in the bank , bank will be the receiver , hence it will be debited & cash is going out cash will be credited.

ii) If cash is withdrwan from bank , bank will be the giver , hence it will be credited & as cash is coming hence cash is debited.

5. If some cheque is sent to bank is dishonored i.e. bank is not able to collect the amount , it is entered in bank column on credit side with the name of related party in particular column.

6. If some cheque issued by the firm is not paid on presentation , it is entered in the bank column on debit side with the name of party to whom cheque was given.

7. In rare case , a cheque received may be given to some other party i.er . endorsed. On receipt it must have been entered on bank column on debit side. On endorsement the amount will be written in the bank column on the credit side.

What are the advantages of three column CB ?

- Cash and Bank accounts are prepared simultaneously , therefore the double entry is completed in the cash book itself.

- Thus the contra entries can be easily cross -checked in the cash column in one side and bank column in the other side of cash book . Also the chances of error are reduced.

- The information regarding cash in hand and bank balance can be obtained easily and quickly as there is no need to prepare Ledger of the bank account.

- In case of maintaining more than one bank account , separate column can be add for each bank account. The transaction between these two or more bank accounts can be recorded and tallied with much less effort.

Balancing of Three column CB

It should be noted that the discount columns are totalled not balanced. The cash column are totalled exactly in the same manner mentioned in single column CB. The process in similar for bank column also.

However bank may allow the firm to withdraw more than the amount deposited i.e. to have an overdraft , in such case total of the bank column on the credit side is bigger than the one on the debit side . The difference is written as ” To balance c/d” . Then totals are written on the two sides opposite one another , the balance is then entered on the credit side as ” By balance b/d”.