Discount Rate

Discount Rate is the rate used to calculate present value of future cash flows . It is rate which depends on the risk free rate and risk premium of an investment. Further, actually each cash flow stream coming from different…

Discount Rate is the rate used to calculate present value of future cash flows . It is rate which depends on the risk free rate and risk premium of an investment. Further, actually each cash flow stream coming from different…

Internal rate of return (irr) is defined as that discount rate which equates the present value of future cash flows of a security to its market value. Irr is viewed as the average annual rate of return that investors earn…

Dividend is the shareholders return on their investment/capital in the company. And it is the part of distributable profits which has been paid out to them. Content 1. Definition of dividend 2. Types of dividend i) Classification is based on…

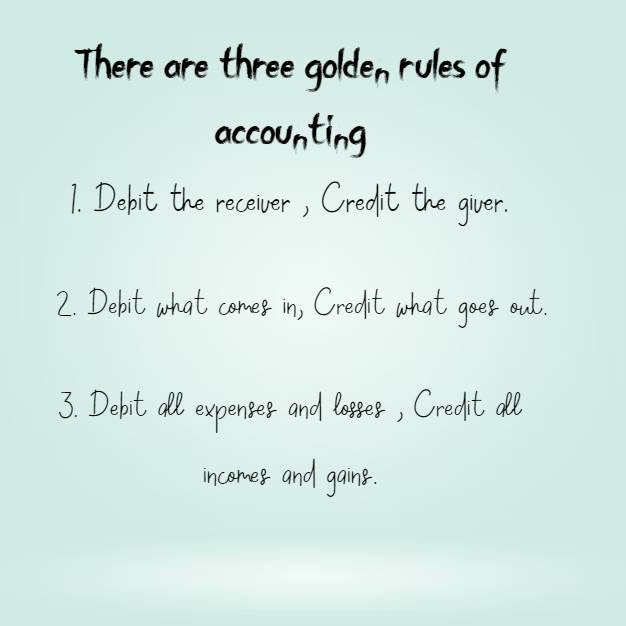

There are three Golden rules of accounts are as follows: 1. Debit the receiver , Credit the giver 2. Debit what comes in, Credit what goes out. 3. Debit all expenses and losses , Credit all incomes and gains. Let…

Marginal costing means change in total cost due to production of an additional unit of output. And it is a variable cost applied to the unit cost. Index 1. What is marginal cost? 2. What is marginal costing ? 3.…

Cost volume profit(CVP)analysis is important tool of profit planning & provides information about following i.e. cost, profit and volume. Content 1. Meaning of Cost volume profit(CVP)analysis 2. What is the meaning of break even analysis and formula? 3. Elaboration of…

Activity Ratios assess the efficiency of the business in using its resources to make maximum possible revenue. And also measures how well the resources has been used by an enterprises. Further, it measures the effectiveness with which the enterprise uses…

Profitability Ratios is an accounting ratio measuring the profitability of the business. And Efficiency is measured by profitability. Further, different ratios are determined using accounting information collected from the financial statements. Profitability ratio shows the final result of the company.…

Petty Cash Book is prepared to record small payments such as telegram, taxi fare , cartage and stationery etc. In a business house a number of small payments such as for telegrams, taxi fare , cartage etc. have to be…

Section 14A of income tax act provides that expenditure incurred by assessee in relation to exempt income is not deductible. Further, section 14A inserted from assessment year 1962-63, provides that no deduction shall be made in respect of expenditure incurred…